The European Banking Authority (EBA) has released its 2023 Benchmarking Report on remuneration trends and practices across EU financial institutions and investment firms. Based on data collected for the period 2021 to 2023 through competent authorities and with a focus on staff that has a material impact on the institutions or investment firm’s risk profile (identified staff), insights from the report are an essential resource for companies aiming to align their remuneration strategies with best practices and regulatory expectations.

Importantly, for the first time, the report includes data on the Gender Pay Gap, revealing a significant challenge for fair pay and equal opportunities.

Remuneration Trends in the EU: Stable, But Not Equal

Remuneration structures have remained broadly stable across the EU banking sector. The ratio between the variable and the fixed remuneration for identified staff of institutions was on average 59.6% in 2023, consistent with previous years. However, higher and more volatile ratios have been observed for investment firms, with the same ratio reaching 145.9% on average in 2023.

The differences in the ratio between institutions and investment firms, as well as its development over time, are driven by more volatile profitability and higher return on equity for investment firms, which help justify more performance-related pay. In addition, the regulatory framework limits the ratio between the variable and fixed remuneration for identified staff in institutions to a maximum of 100% (200% with shareholders’ approval), while such a limitation does not apply to all investment firms.

Firms continue to apply deferral policies and use financial instruments for variable pay, especially for senior management and control functions. The use of derogations for staff earning under €50,000 in variable pay remain common, allowing more flexibility in pay structures for that level of variable remuneration.

Persistent Gender Disparities

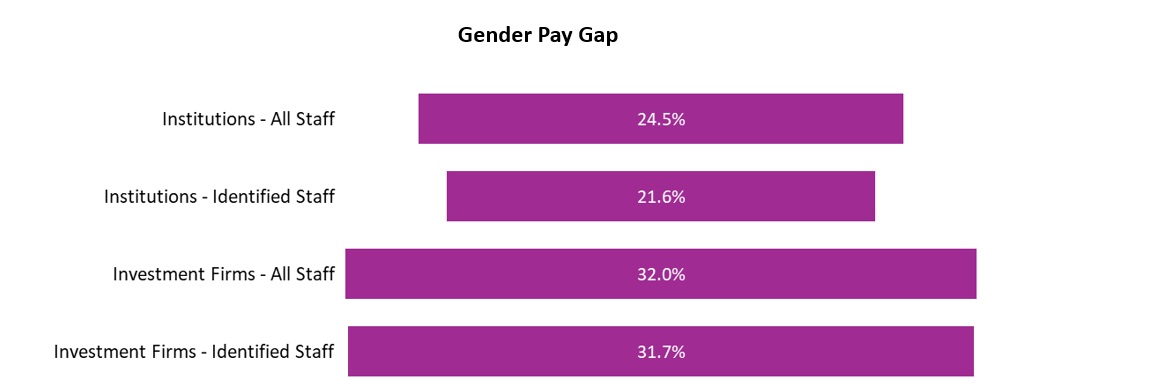

Perhaps the most striking findings in this year’s report relate to the Gender Pay Gap. EBA reports on the unadjusted Gender Pay Gap, which is the difference between the average pay between male and female staff divided by the remuneration of male staff. The report highlights a persistent and concerning Gender Pay Gap across institutions and investment firms. Women earn on average 24.5% less than men in banking institutions whereas the gap rises to 32.0% in investment firms.

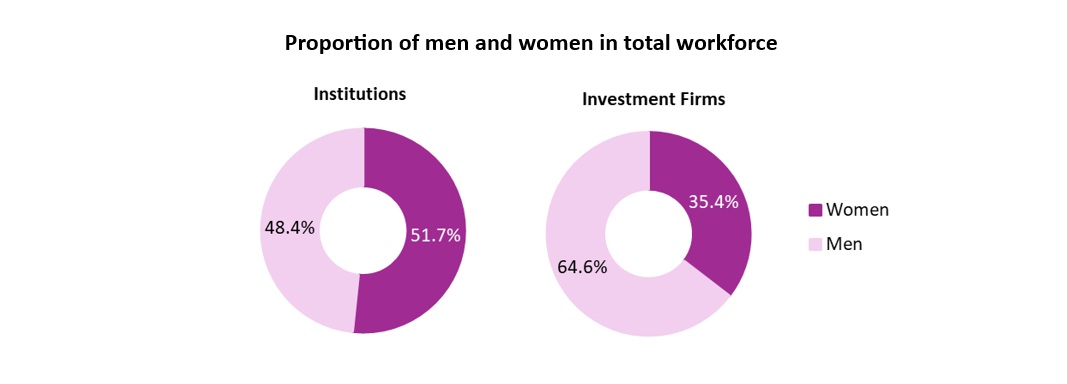

While on average, women and men are equally represented in banking institutions, women are underrepresented in investment firms. The representation of women in the group of identified staff is significantly lower with a median value of 28% in institutions and 20% in investment firms.

The primary cause of the Gender Pay Gap is not unequal pay for equal work, but rather the underrepresentation of women in senior, higher-paid roles. Women are overrepresented in the lowest pay quartiles and significantly underrepresented in the highest ones. In banking institutions, about 33% of top earners are women, whereas in investment firms only about 13% of top earners are women.

The materiality of the observed Gender Pay Gap and gender imbalances in higher paid and risk-taking positions raises concerns about the obligation of banking institutions and investment firms to ensure equal opportunities for male and female staff.

Why it Matters

The EBA’s findings are not just regulatory observations – they are a call to action.

While overall stability in pay trends is reassuring, the ongoing gender pay disparities demand urgent and focused attention from both banking institutions/investment firms and supervisory bodies. The report highlights the need for companies to further analyse the reasons for the observed Gender Pay Gap, take proactive steps to promote equal opportunities, improve gender diversity in leadership positions and continually monitor pay equity across all levels. Regulatory scrutiny around fair remuneration practices is intensifying — making this both a compliance and a reputational risk.

Need support navigating remuneration challenges and building a fairer workplace? Contact us today to find out how we can help.

Loukia Ioannou, CFA

Principal at C.Y Actuaries

The views expressed above are solely of the author and do not necessarily represent the view of Cronje & Yiannas Actuaries and Consultants Ltd.